The world of currency markets is always changing. Here you’ll find the latest news and analysis on everything from currency valuation to market trends, new regulations, and more. Explore our blog to stay up-to-date on everything you need to know in the world of Forex. If you’re considering investing in the foreign exchange market, it can be helpful to understand what that means and why it’s important. The foreign exchange market, also known as FX or currency market, is where investors trade currencies — such as the U.S. dollar, euro, British pound, or Japanese yen — for their inherent value as a medium of exchange rather than for their stable value as a store of value or potential for future earnings.

Currency Market Basics

The Forex market is open 24 hours a day, five days a week. The market doesn’t take weekends off, although volumes are generally lower during the weekend.

The market’s open-ended nature also means that there is no official close — currency prices may change at any given moment, even if there is no trading taking place. The global foreign exchange market is the largest financial market in the world.

It’s also the most liquid — meaning that it’s the easiest to trade. The market is primarily made up of banks, multinational corporations, and hedge funds, which trade trillions of dollars internationally every day. The average retail investor makes up a very small percentage of the market.

Forex Market Types

There are two main types of Forex trading markets: the spot market and the futures market.

Spot Market

The spot market is where currencies are traded for immediate delivery. This market is most often used for large transactions. The spot market does not have any set rules, regulation,s or procedures. The next market segment, the futures market, is a bit more standardized.

Futures Market

The futures market is where currencies are traded for future delivery. Investors who use the futures market are generally interested in making a bet on the future value of a currency. The futures market is standardized and governed by a set of rules, regulations and procedures.

Forex Trading Tools

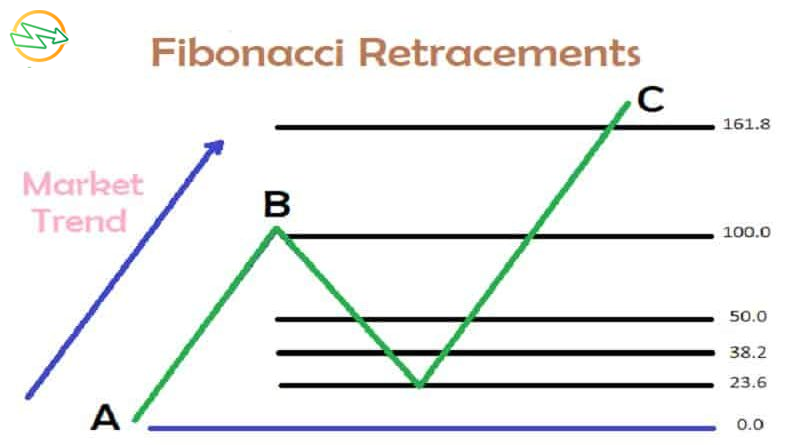

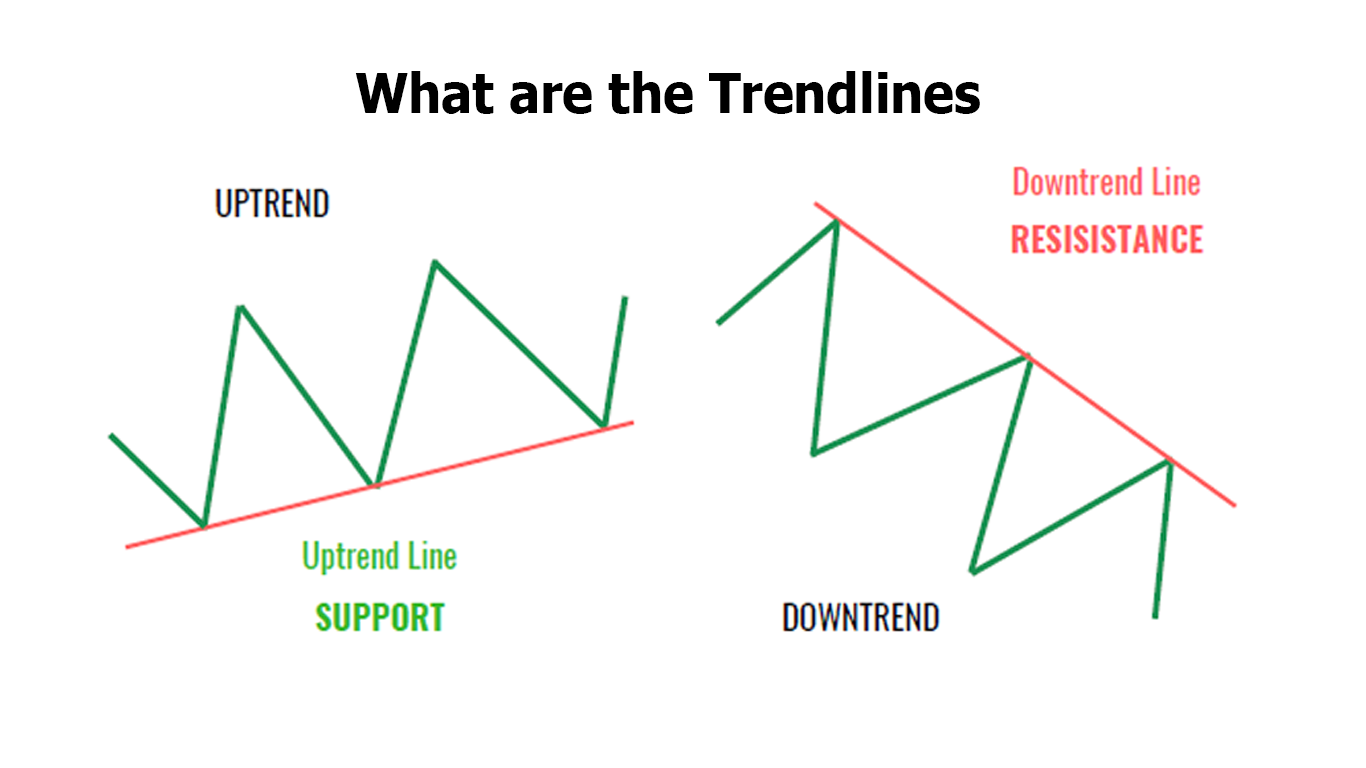

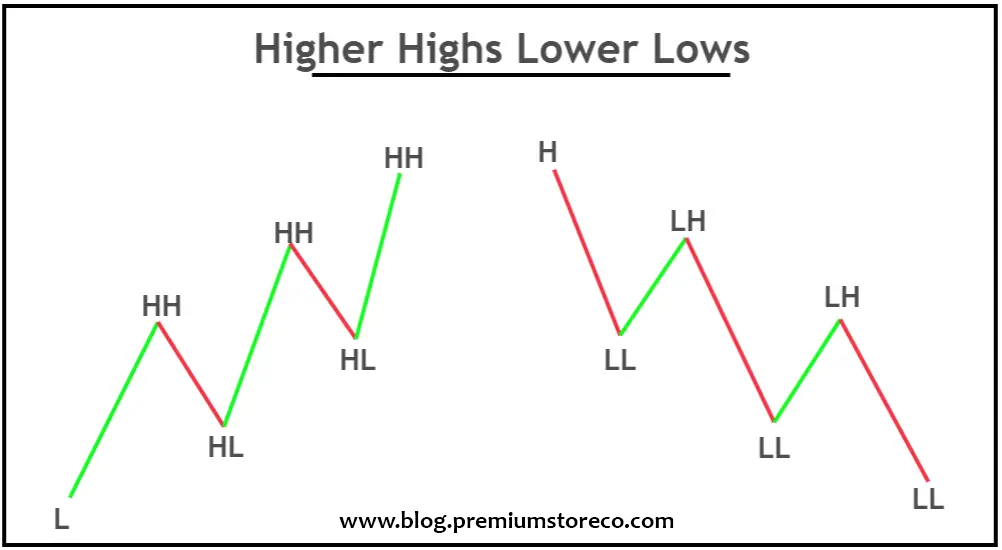

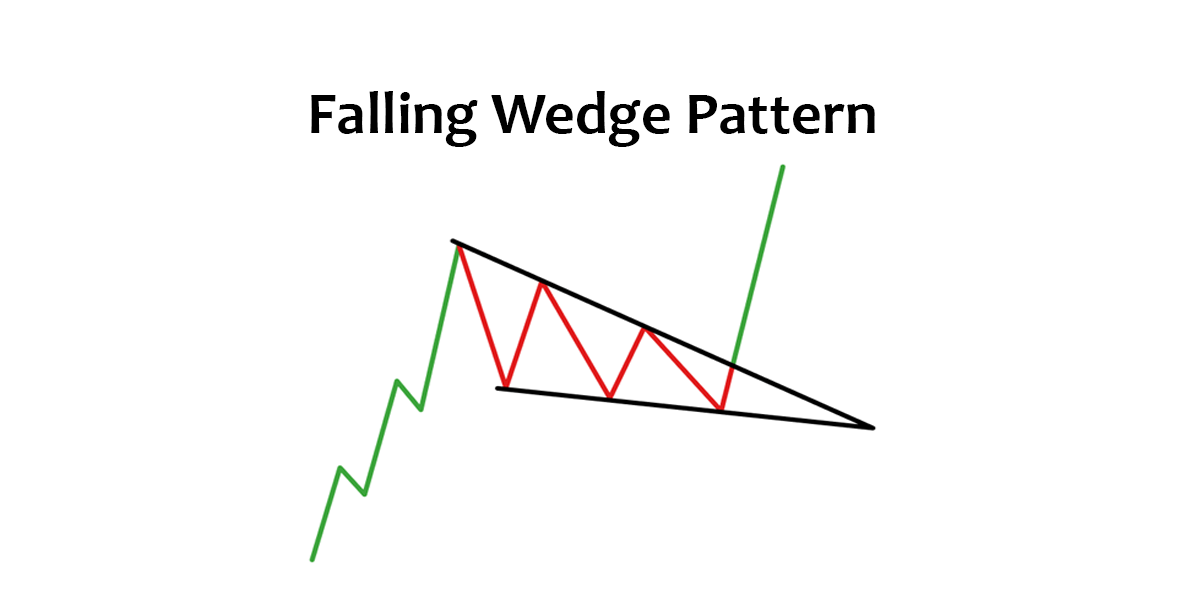

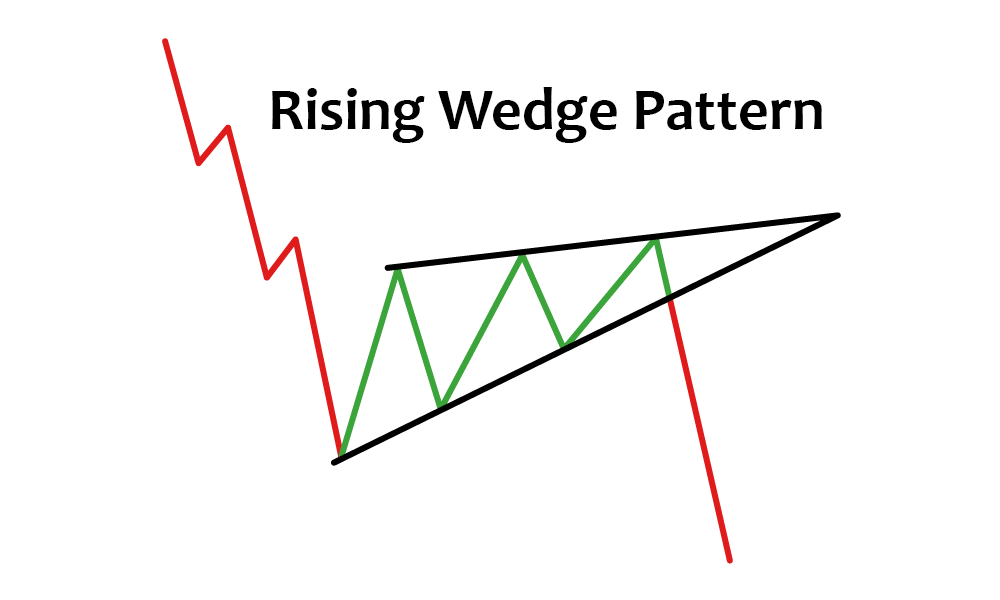

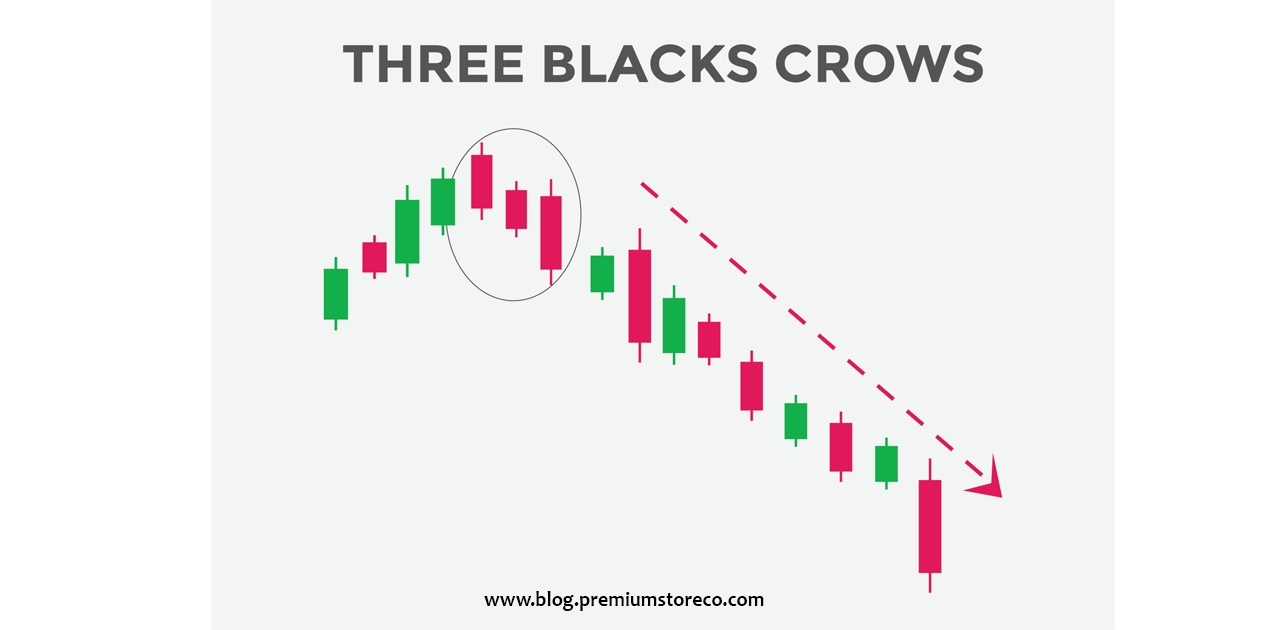

Many currency traders use charts to help them make investment decisions. A chart is a visual representation of a currency’s performance over time. Traders use charts to make decisions on when to buy or sell a currency. They also use charts to track currencies against each other.

There are many charting tools available to currency traders, some more advanced than others. Standard charting tools include line charts, bar charts, and price-and-volume charts. Standard charting tools can help you better understand the movement of a currency over time and how it relates or corresponds, with other currencies.

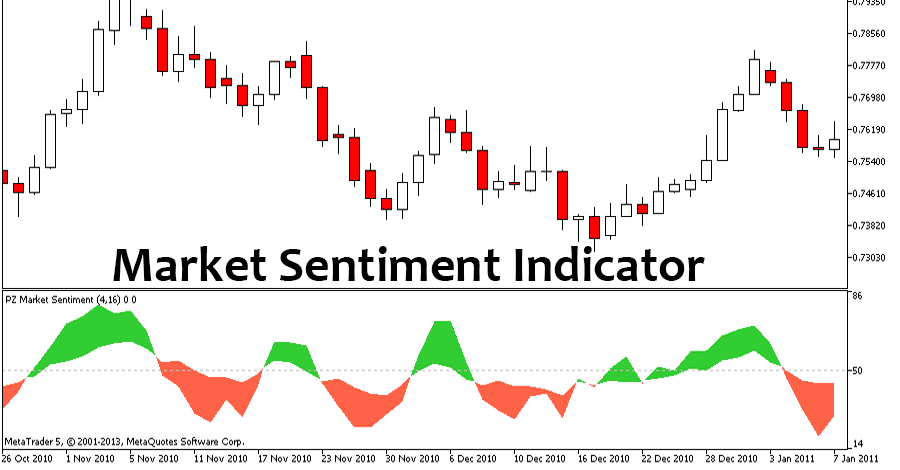

Some currency traders, especially those in more advanced trading environments, use technical indicators as part of their analysis. Technical indicators are mathematical formulas that attempt to identify changes in market conditions.

Forex Trading Strategies

When it comes to choosing a strategy, there’s no one-size-fits-all approach. You may find that a combination of strategies works best for you. Some traders may use technical analysis to inform their decisions, while others may use fundamental analysis to guide their decisions.

There are many different strategies you can use to trade currencies. You may even combine a few strategies to create a trading strategy that is perfectly suited for your risk tolerance and financial situation.

Currency Valuation

Currency valuation is the process of determining the value of a particular currency. In the case of the Forex market, value is determined based on how much money a given currency is worth in comparison with other currencies.

Let’s say that the British pound is trading at $1.50. That means one British pound is worth $1.50 in comparison with the U.S. dollar. Although the actual process of valuing currencies is more complicated, the above example shows how the value of a currency is determined.

Currency valuation is important because it has a direct impact on the price of goods and services sold in a given country. For example, if the price of goods in the U.K. increases, it will have a ripple effect on the U.S. economy, as British goods will cost more in American dollars.

FX Regulations

Many countries have regulatory bodies that oversee the financial sector and determine what is and isn’t permissible in the currency markets. You may be required to obtain a license to trade currency or abide by specific capital requirements to ensure that you have the financial resources to cover potential losses. The Financial Conduct Authority (FCA) regulates the currency markets in the U.K.

The Commodity Futures Trading Commission (CFTC) in the U.S. is responsible for regulating the futures market. The Securities and Exchange Commission (SEC) is the regulator for the spot market in the U.S. The Federal Reserve Bank (Fed) regulates the U.S. dollar in the spot market. There are also various other bodies that oversee other currencies. It’s important to understand the regulations in your home country, as well as those for the countries with which you trade.

Bottom Line

A thorough understanding of the Forex market is essential before diving in. Before you make any investment decision, it’s important to do your research and pick a strategy that works for you.

The key to success in the world of currency markets is a combination of knowledge, research, and discipline. If you’re considering investing in the foreign exchange market, it’s important to understand what that means and why it’s important.

The foreign exchange market, also known as FX or currency market, is where investors trade currencies — such as the U.S. dollar, euro, British pound, or Japanese yen — for their inherent value as a medium of exchange rather than for their stable value as a store of value or potential for future earnings.

GENERAL RISK WARNING

NOTE: This article is not investment advice for anyone because online trading could be a high risk for all who have a lack of knowledge & experience. 86% of traders lose money in financial markets. we are not your financial advisors who guarantee your profit at all.