Are you looking for a way to gain an edge in the stock market? Japanese candlestick patterns can help you understand market sentiment and make profitable trading decisions. In this article, we’ll discuss what Japanese candlestick patterns are, their benefits, and how to use them to take your trading to the next level.

What Are Japanese Candlestick Patterns?

Japanese candlestick patterns are technical analysis tools that traders use to predict future market movements. They were first used by Japanese rice traders in the 1700s and are now used by traders all over the world.

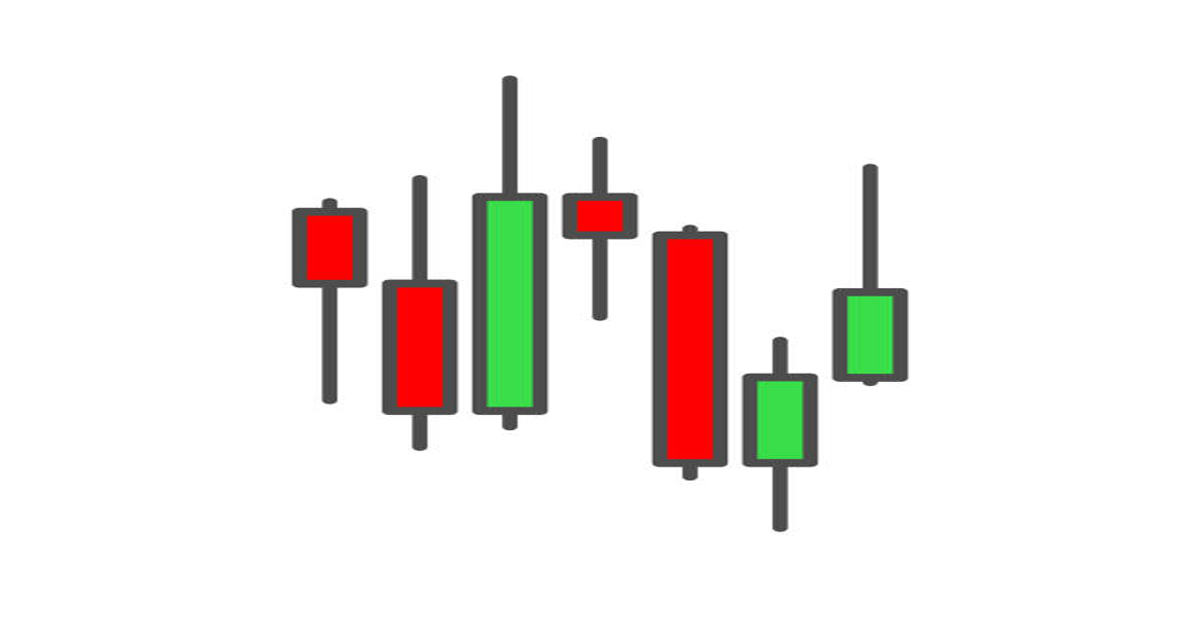

Japanese candlestick patterns are graphical representations of price movement. Each candlestick is composed of an open, high, low, and close price. The body of the candle is made up of the open and close prices, while the wicks represent the high and low prices.

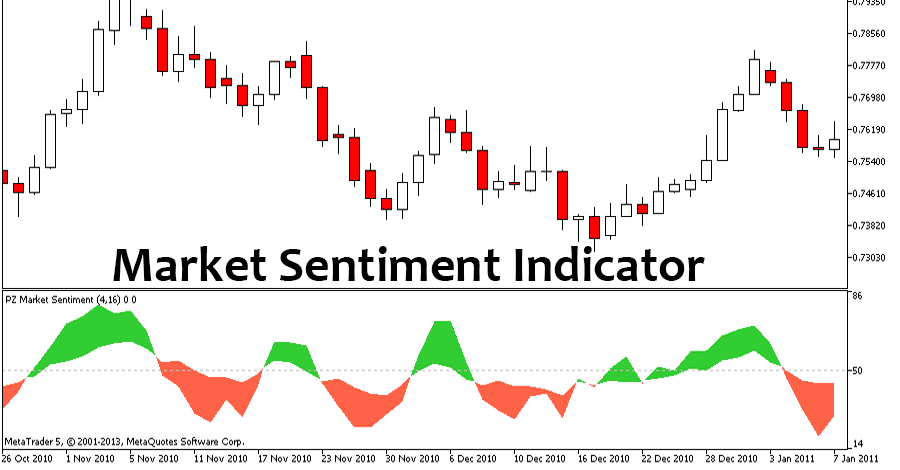

The shape of the candlestick and the relationship between the open and close prices can provide insight into the market sentiment, offering clues about whether a stock is likely to rise or fall.

Benefits of Mastering Japanese Candlestick Patterns

There are many benefits to mastering Japanese candlestick patterns. Firstly, candlestick patterns can help you identify potential entry and exit points for trades. By understanding the patterns, you’ll be able to make more informed decisions about when to buy and sell.

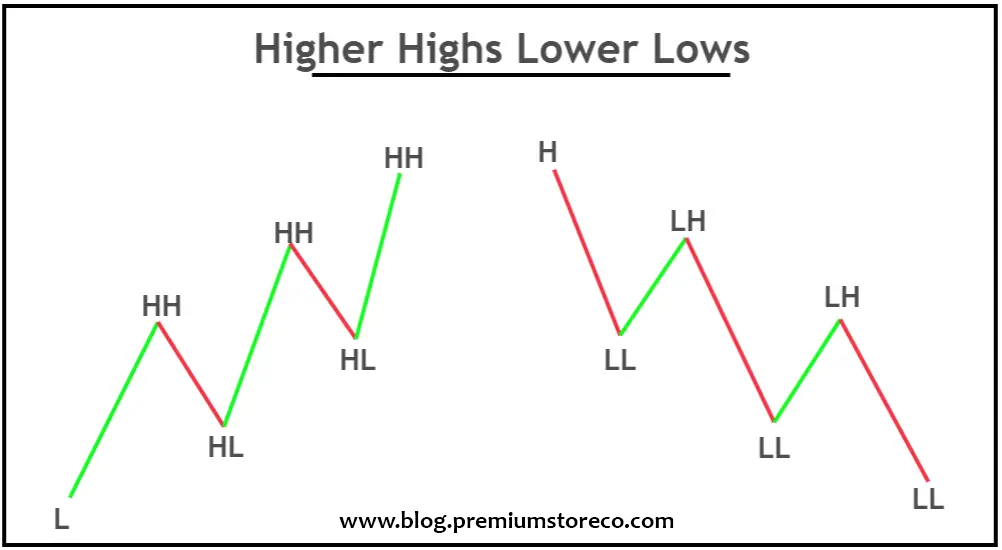

Furthermore, candlestick patterns can help you spot potential market trends. By analyzing the patterns, you can get a better idea of where the market is heading and make trading decisions accordingly.

Finally, mastering Japanese candlestick patterns can help you develop a deeper understanding of the trading market. By learning how to read the patterns, you’ll gain a better insight into the market sentiment and be able to make more informed decisions.

Japanese Candlestick Patterns Explained

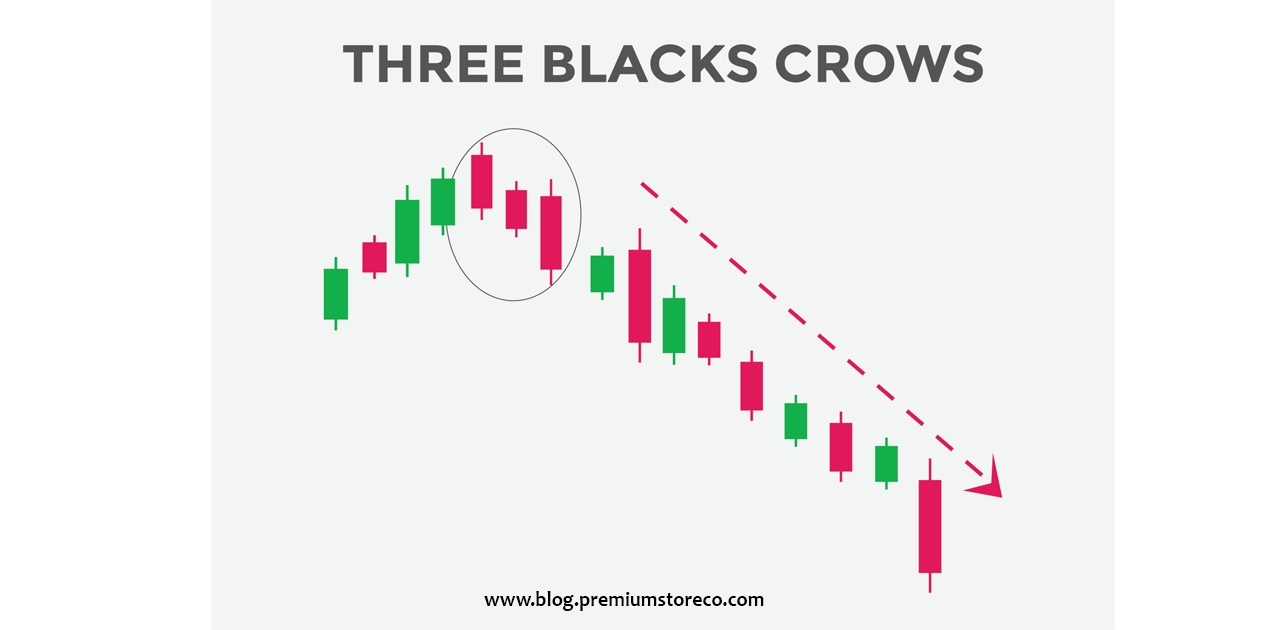

Japanese candlestick patterns are composed of a few key elements. Firstly, the body of the candlestick is made up of the open and close prices. If the close price is higher than the open price, the body is green, indicating that the market is bullish. If the close price is lower than the open price, the body is red, indicating that the market is bearish.

The upper and lower shadows of the candlestick represent the high and low prices for the period. The length of the shadows can provide clues about the strength of the trend. If the upper and lower shadows are long, it indicates that the market is volatile. If the shadows are short, it indicates that the market is less volatile.

The relationship between the open and close prices can also provide clues about the direction of the trend. If the close price is higher than the open price, it indicates that the market is in an uptrend. If the close price is lower than the open price, it indicates that the market is in a downtrend.

Common Japanese Candlestick Patterns

There are many different types of Japanese candlestick patterns, but the most common ones are the Doji, Hammer, Shooting Star, and Engulfing patterns.

Doji patterns are one of the most common Japanese candlestick patterns. They are formed when the open and close prices are close together, indicating that the market sentiment is uncertain.

Hammer patterns are formed when the open and close prices are close together, but the lower shadow is much longer than the upper shadow. This indicates that the market is in an uptrend.

Shooting Star patterns are formed when the open and close prices are close together, but the upper shadow is much longer than the lower shadow. This indicates that the market is in a downtrend.

Engulfing patterns are formed when the open and close prices of one candlestick completely cover the body of the previous candlestick. This indicates that the market is likely to reverse direction.

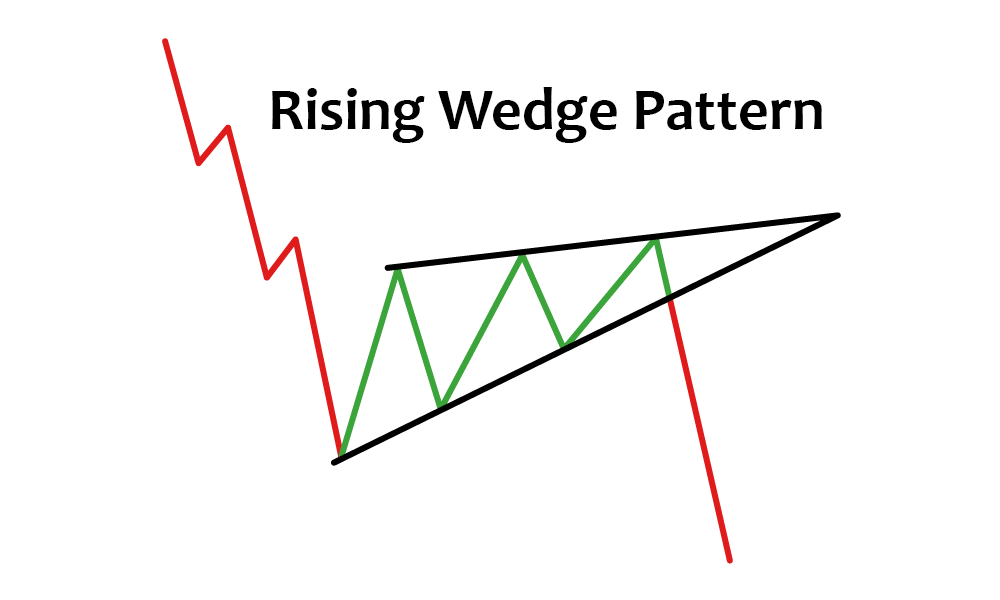

Reversal Japanese Candlestick Patterns

Reversal Japanese candlestick patterns indicate that the current trend is likely to reverse direction. The most common reversal patterns are the Double Top, Double Bottom, Head and Shoulders, and Inverted Head and Shoulder patterns.

Double Top patterns are formed when the price reaches the same level twice, indicating that the uptrend is likely to reverse.

Double Bottom patterns are formed when the price reaches the same level twice, indicating that the downtrend is likely to reverse.

Head and Shoulders patterns are formed when the price reaches a peak, dips down, then rises to a lower peak, indicating that the uptrend is likely to reverse.

Inverted Head and Shoulder patterns are formed when the price reaches a trough, rises to a lower trough, then dips down, indicating that the downtrend is likely to reverse.

Continuation Japanese Candlestick Patterns

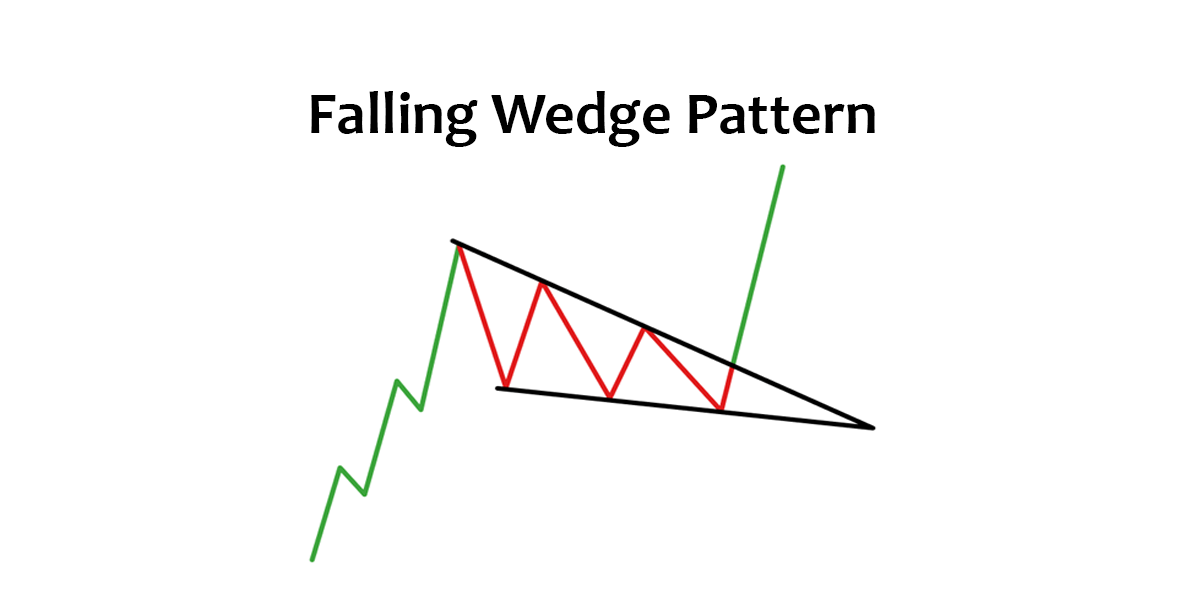

Continuation Japanese candlestick patterns indicate that the current trend is likely to continue. The most common continuation patterns are the Flag, Pennant, Symmetrical Triangle, and Ascending Triangle patterns.

Flag patterns are formed when the price moves in a narrow range, indicating that the trend is likely to continue.

Pennant patterns are formed when the price moves in a triangle, indicating that the trend is likely to continue.

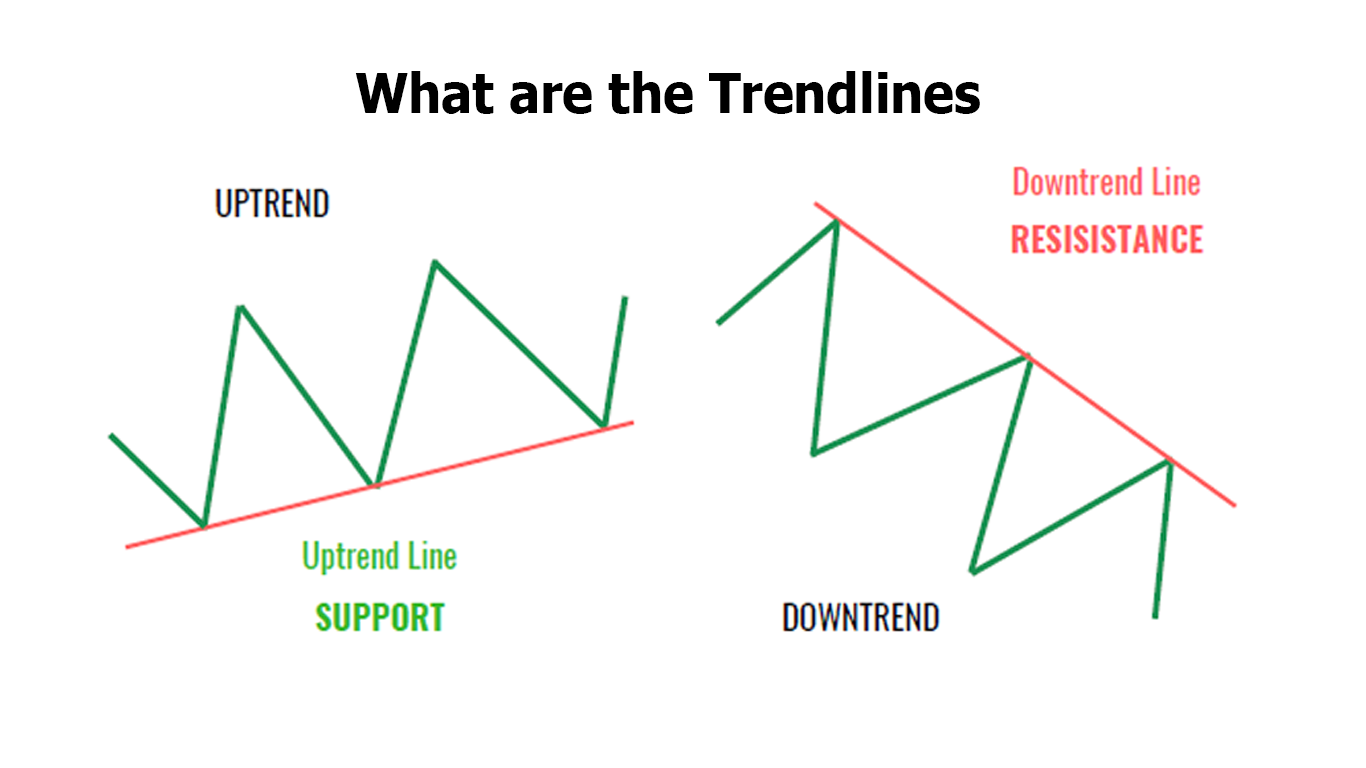

Symmetrical Triangle patterns are formed when the price moves in a triangle with two converging trendlines, indicating that the trend is likely to continue.

Ascending Triangle patterns are formed when the price moves in a triangle with an upward-sloping trendline, indicating that the uptrend is likely to continue.

How to Identify Japanese Candlestick Patterns

Identifying Japanese candlestick patterns can be tricky, but there are a few tips that can help you spot the patterns more easily. Firstly, you should look for patterns that have a clear body, as this will indicate that the market sentiment is strong.

Then, you should look for patterns that have long shadows, as this will indicate that the trend is strong. Finally, look for patterns that have a clear relationship between the open and close prices, as this will indicate the direction of the trend.

How to Use Japanese Candlestick Patterns in Trading

Once you’ve identified a Japanese candlestick pattern, you can use it to make trading decisions.

For example, if you spot a Double Top pattern, you could use this as a signal to enter a short position, as it indicates that the uptrend is likely to reverse.

Likewise, if you spot an Ascending Triangle pattern, you could use this as a signal to enter a long position, as it indicates that the uptrend is likely to continue.

It’s important to remember that Japanese candlestick patterns are not infallible. They can provide useful insights into the market sentiment, but it’s important to use other technical analysis tools to confirm your trading decisions.

Conclusion

Japanese candlestick patterns can be a valuable tool for traders. By understanding the patterns, you can gain valuable insights into the market sentiment and make more informed trading decisions.

If you’re looking for a way to gain an edge in the financial markets, Japanese candlestick patterns can help you understand market sentiment and make profitable trading decisions. Mastering Japanese candlestick patterns can help you take your trading to the next level.

GENERAL RISK WARNING!

NOTE: This article is not investment advice for anyone because online trading could be a high risk for all who have a lack of knowledge & experience. 86% of traders lose money in financial markets. we are not your financial advisors who guarantee your profit at all.