By Premium Store

/ August 10, 2023

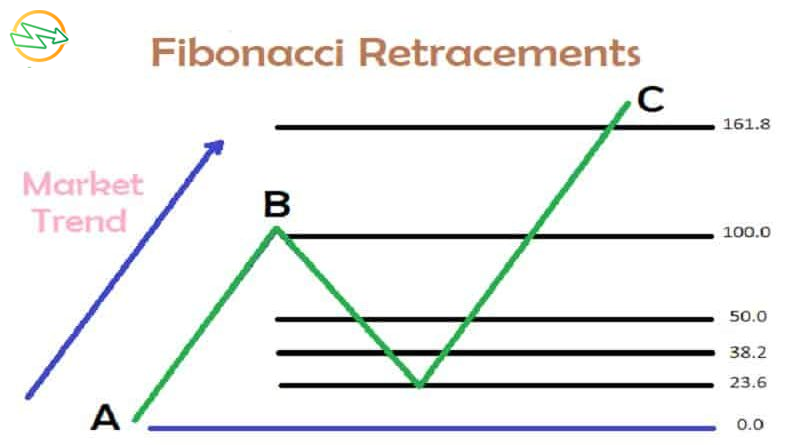

Technical analysis is an essential component of trading, and one popular tool that traders often use is Fibonacci retracement levels....

Read More

Breakout Trading: A Strategy for Active Investors

By Premium Store

/ July 6, 2023

Breakout trading is a popular strategy used by active investors to take advantage of price movements in the early stages...

Read More

Understanding Trendlines: A Powerful Tool for Traders and Analysts

By Premium Store

/ July 1, 2023

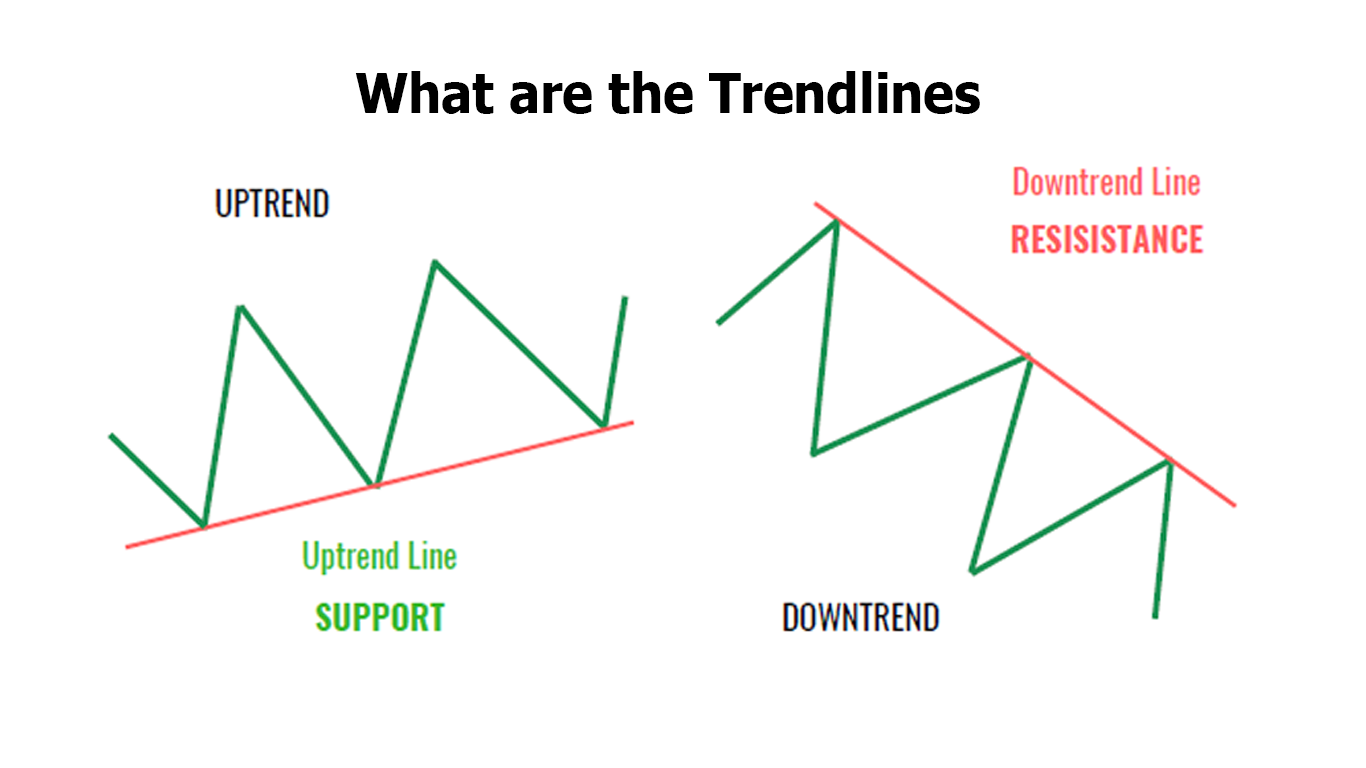

In the world of trading and financial analysis, trendlines play a crucial role in helping traders predict the direction of...

Read More

Market Sentiment Indicators: Understanding Investor Psychology and Market Behavior

By Premium Store

/ June 27, 2023

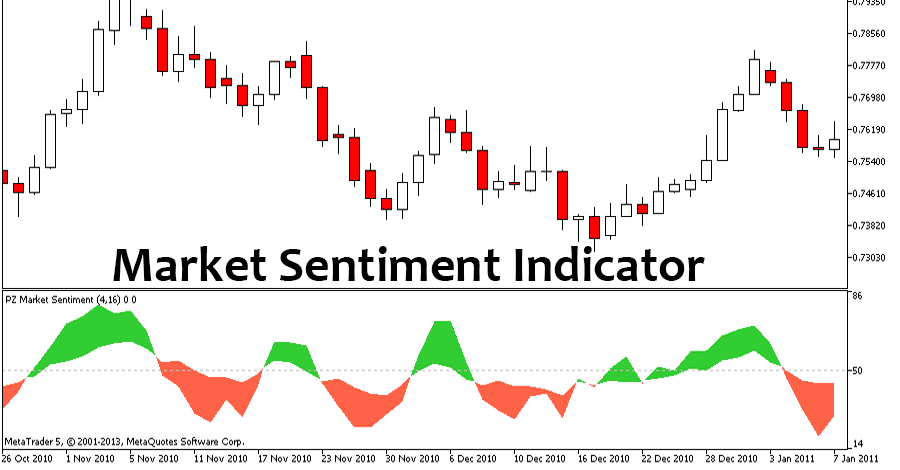

Investing in the stock market is not just about analyzing numbers and financial data. It also involves understanding the human...

Read More

Understanding the Intricacies of Market Volatility

By Premium Store

/ June 24, 2023

The stock market is an ever-changing landscape. The constancy of change is the only thing that remains constant. Market indexes...

Read More

Mastering Pullbacks Strategies in Trading: Strategies, Entry Points, and Risk Management

By Premium Store

/ June 23, 2023

Pullbacks in trading can present excellent opportunities for traders to enter or exit positions at favorable prices. However, profiting from...

Read More

Higher Highs and Higher Lows in Trading

By Premium Store

/ June 18, 2023

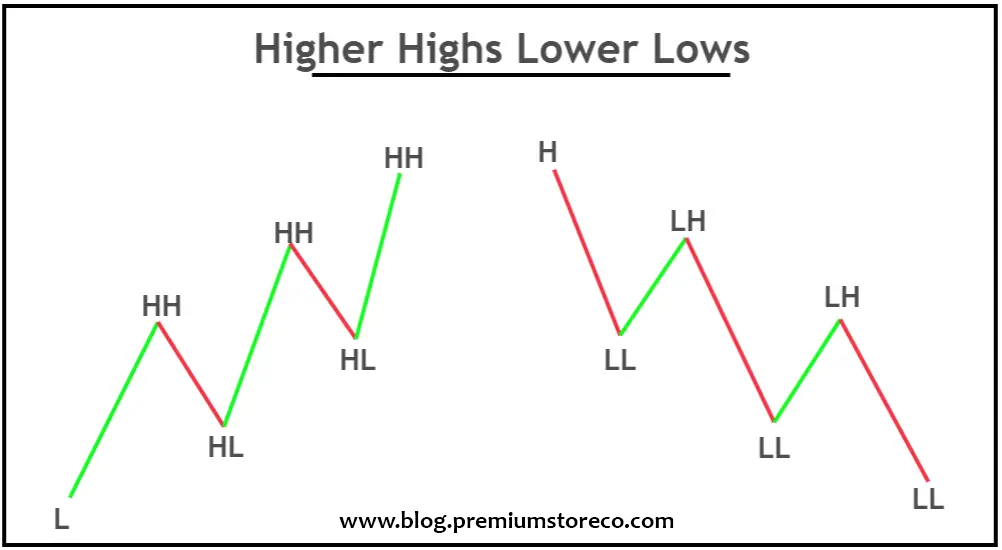

Introduction In the world of trading, understanding the nuances of market structure is crucial for success. Terms like higher highs...

Read More

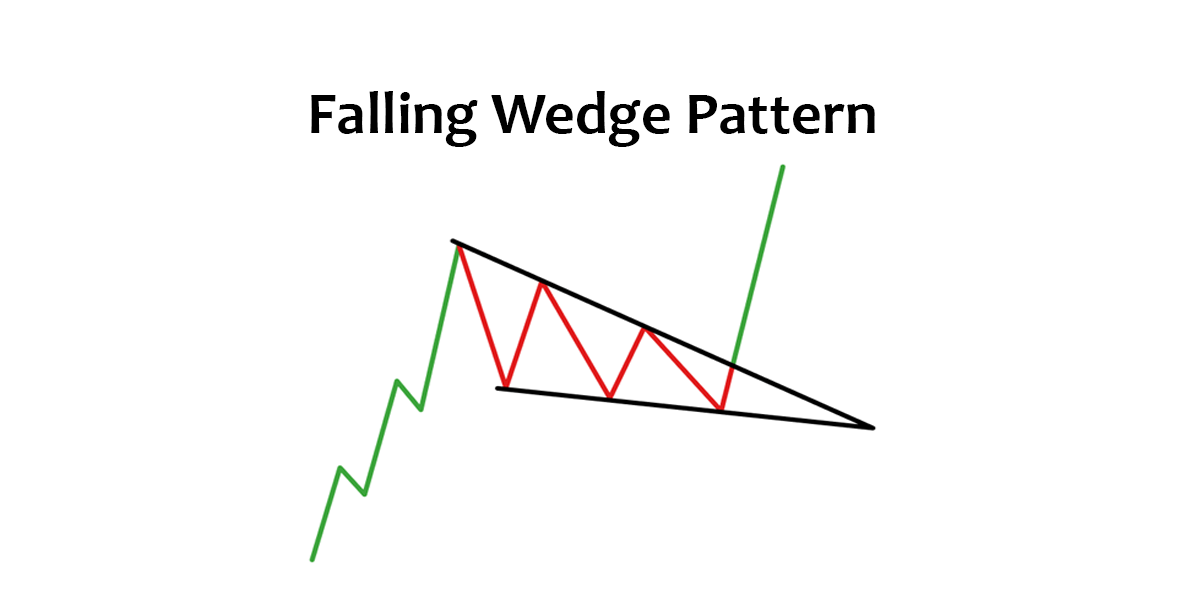

Demystifying the Falling Wedge Pattern

By Premium Store

/ June 12, 2023

As an investor or trader, understanding various chart patterns and technical indicators is crucial to making informed decisions. One such...

Read More

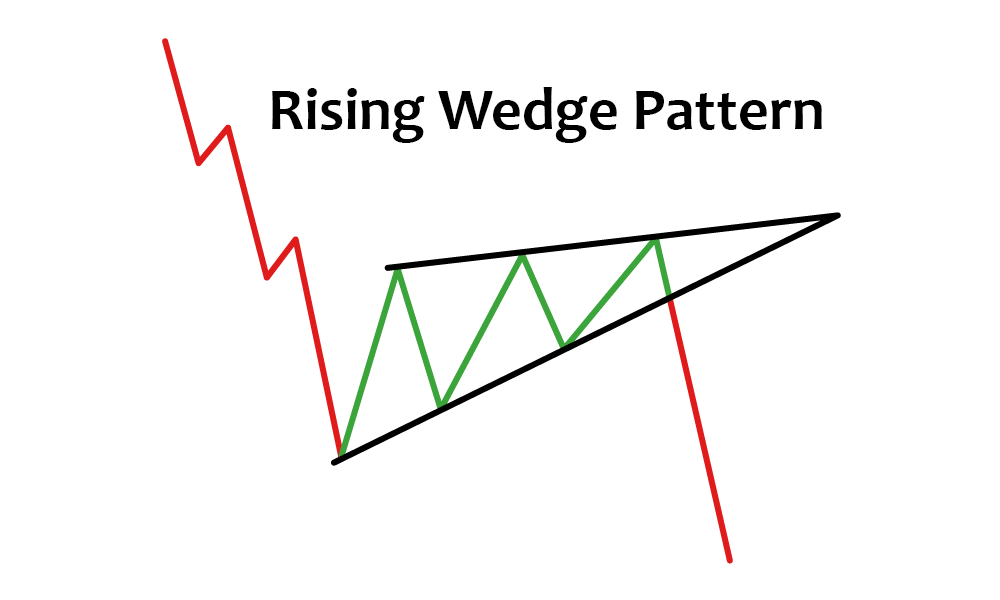

Mastering the Rising Wedge Pattern

By Premium Store

/ June 11, 2023

A rising wedge pattern is a popular chart pattern that traders use to identify potential reversals in the market. In...

Read More

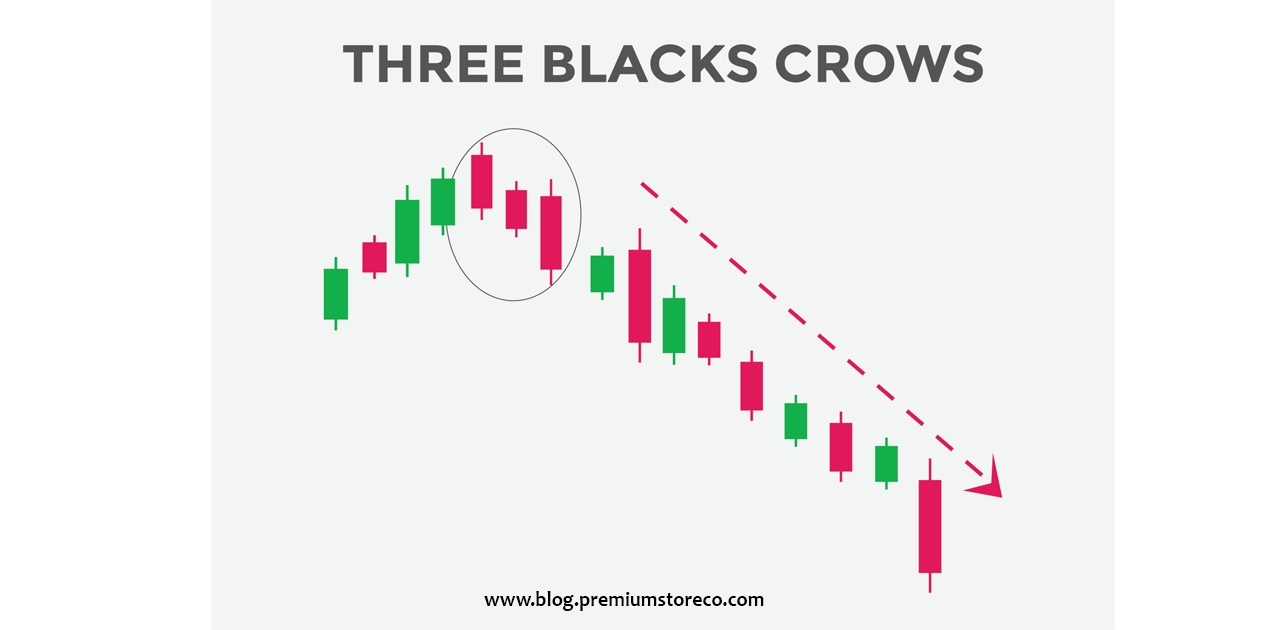

The Three Black Crows Candlestick Pattern

By Premium Store

/ June 10, 2023

What are Three Black Crows? The Three Black Crows is a term used in the world of technical analysis to...

Read More